The CashValue_SE Model#

Overview#

The CashValue_SE model projects cashflows

of a generic hypothetical savings product.

The model is a monthly-step model and

projects insurance cashflows of a sample model point at a time.

The model can project both new business and in-force policies.

The present values of cashflows are also calculated.

By default, the model is configured as follows:

4 types of product specs, A, B, C, D are available. The spec parameters are read into

product_spec_tablefrom the file product_spec_table.xlsx in the model folder.A and B are single premium products with limited policy terms, while C and D are level premium whole life products. A and B are simulate variable annuities, while C and D are simulate variable life.

By default, 4 model points, 1 for each product type, are set up. The 4 model points are new business policies issued at time 0. The model can also project in-force policies at time 0 or future new business policies issued after time 0.

Premiums, net of premium loadings if applicable, are transferred to the account value. Maintenance fees and cost-of-insurance charges are deducted from the account value at the beginning of every month. The investment return is then added to/subtracted from the account value. The investment returns are calculated from standard normal random numbers read into

std_norm_randfrom the file std_norm_rand.csv.Upon death, a death benefit is paid. The amount of the death benefit is the greater of the sum assured and the account value. The entire account value is transferred for paying the death benefit.

Upon lapse, the account value is paid out as surrender benefit. Whether surrender charge applies or not varies by the product types. If it applies, the cash surrender value is the account value net of the surrender charge amount.

For A and B, the maturity benefit is paid at maturity. The remaining account value is paid as the maturity benefit.

Depending on the product types, premium loads are collected and the remaining portions of the premiums are transferred to the account value. How much premium loading is collected from each premium varies by the product types, and it is specified in product_spec_table.xlsx. Whether each type has surrender charge and if so its percentages are also specified in the file.

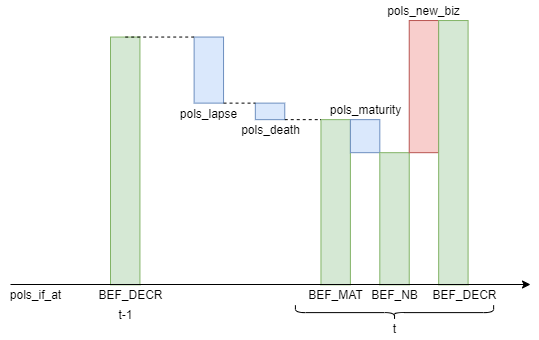

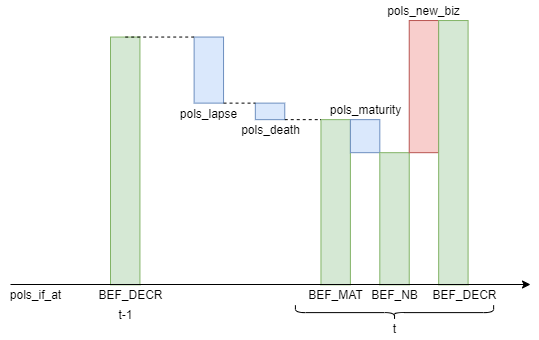

Policy decrement#

The number of policies at a certain time can take different values

depending on the timing of policy inflows and outflows at the same time.

To represent different values for the number of policies

depending on the timing of the policy flows,

pols_if_at(t, timing) is introduced.

pols_if_at(t, timing)

calculates the number of policies in-force

at time t and has a parameter named timing in addition to t.

Strings are passed to timing to indicate at what timing the number

of polices in-force is measured.

"BEF_DECR": Before lapse and death"BEF_MAT": Before maturity"BEF_NB": Before new business

The figure below illustrates how various policy inflows and outflows

are modeled in this model for one calculation step

from time t-1 to time t.

pols_lapse(t) and pols_death(t)

are the number of lapse and death from t-1 to t.

It is assumed that policies mature at the beginning of each month,

and new business policies enter at the beginning of the month

but after the maturity in that month.

Although the default model points are all new business policies,

CashValue_SE reads the duration of each model

point at time 0 from the model point file.

The duration of a model point being N months (N > 0) means

N months have elapsed before time 0 since the issue of the model point.

If the duration is -N months, the model point is issued

N months after time 0.

model_point_table has the duration_mth column,

and the column is read into the duration_mth(0).

If duration_mth(0) is positive,

the model point is in-force policies and

the number of policies

at time 0 is read from the policy_count column in model_point_table

into pols_if_init(), and

pols_if_at(0, "BEF_MAT") is set from pols_if_init().

duration_mth() increments by 1 each step. If duration_mth()

is negative, policy_count is read into pols_new_biz()

when duration_mth() becomes 0.

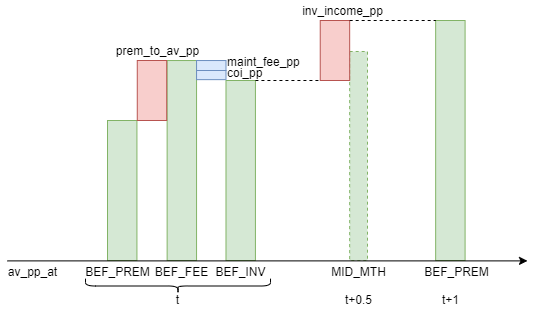

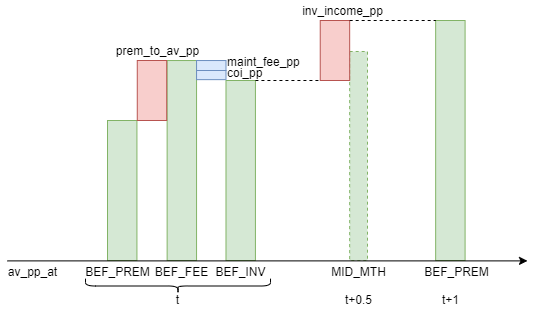

Account value roll-forward#

The account value per policy at each t is calculated

from the previous balance by adding cash inflows and

subtracting cash outflows.

The order and timing of the cashflows are as follows:

At the beginning of each month, premium net of loadings, if any, is put into the account value.

At the beginning of the month after the premium inflow, fees are deducted from the account value.

The investment income is earned on the account value throughout the month. Since policy decrement due to lapse and death is assumed to occur at the middle of the month, half the monthly investment return is assumed to be earned on the account values of the exiting policies.

Basic Usage#

Reading the model#

Create your copy of the savings library by following the steps on the Quick Start page. The model is saved as the folder named CashValue_SE in the copied folder.

To read the model from Spyder, right-click on the empty space in MxExplorer, and select Read Model. Click the folder icon on the dialog box and select the CashValue_SE folder.

Getting the results#

By default, the model has Cells

for outputting projection results as listed in the

Results section.

result_cf() outputs cashflows of the selected model point,

result_pv() outputs the present values of the cashflows,

result_pols() outputs the decrement table of the model point.

All the Cells outputs the results as pandas DataFrame.

See the Quick Start page for how to get the results in an MxConsole and view the results in MxDataViewer.

Changing the model point#

The model point to be selected is determined by

point_id in Projection.

It is 1 by default.

model_point_table contains 4 model points

as a pandas DataFrame.

To change the model point to another one, set the other model point’s ID

to point_id. Setting the new point_id clears

all the values of Cells that are specific to the previous model point.

Getting multiple results#

The Projection space

is parameterized with point_id,

i.e. the Projection space can have dynamic child spaces, such as

Projection[1], Projection[2], Projection[3] …, each of which

represents the Projection for each of the model points.

Note

Getting results for too many dynamic child spaces

takes a considerable amount of time.

The default CashValue_SE model would take more than a minute

for 1000 model points on an ordinary spec PC.

To calculate for many model points,

consider using the CashValue_ME model.

Model Specifications#

The CashValue_SE model has only one UserSpace,

named Projection,

and all the Cells and References are defined in the space.

The Projection Space#

The main Space in the CashValue_SE model.

Projection is the only Space defined

in the CashValue_SE model, and it contains

all the logic and data used in the model.

Parameters and References

(In all the sample code below,

the global variable Projection refers to the

Projection Space.)

- point_id#

The ID of the selected model point.

point_idis defined as a Reference, and its value is used for determining the selected model point. By default,1is assigned. To select another model point, assign its model point ID to it:>>> Projection.point_id = 2

point_idis also defined as the parameter of theProjectionSpace, which makes it possible to create dynamic child space for multiple model points:>>> Projection.parameters ('point_id',) >>> Projection[1] <ItemSpace CashValue_SE.Projection[1]> >>> Projection[2] <ItemSpace CashValue_SE.Projection[2]>

See also

- model_point_table#

All model points as a DataFrame. By default, 4 model points are defined. The DataFrame has an index named

point_id, andmodel_point()returns a record as a Series whose index value matchespoint_id. The DataFrame has the following columns:spec_idage_at_entrysexpolicy_termpolicy_countsum_assuredduration_mthpremium_ppav_pp_init

Cells defined in

Projectionwith the same names as these columns return the corresponding column’s values for the selected model point.>>> Projection.model_poit_table spec_id age_at_entry sex ... premium_pp av_pp_init poind_id ... 1 A 20 M ... 500000 0 2 B 50 M ... 500000 0 3 C 20 M ... 1000 0 4 D 50 M ... 1000 0 [4 rows x 10 columns]

The DataFrame is saved in the Excel file model_point_samples.xlsx placed in the model folder.

model_point_tableis created by Projection’s new_pandas method, so that the DataFrame is saved in the separate file. The DataFrame has the injected attribute of_mx_dataclident:>>> Projection.model_point_table._mx_dataclient <PandasData path='model_point_table_samples.xlsx' filetype='excel'>

- disc_rate_ann#

Annual discount rates by duration as a pandas Series.

>>> Projection.disc_rate_ann year 0 0.00000 1 0.00555 2 0.00684 3 0.00788 4 0.00866 146 0.03025 147 0.03033 148 0.03041 149 0.03049 150 0.03056 Name: disc_rate_ann, Length: 151, dtype: float64

The Series is saved in the Excel file disc_rate_ann.xlsx placed in the model folder.

disc_rate_annis created by Projection’s new_pandas method, so that the Series is saved in the separate file. The Series has the injected attribute of_mx_dataclident:>>> Projection.disc_rate_ann._mx_dataclient <PandasData path='disc_rate_ann.xlsx' filetype='excel'>

See also

- mort_table#

Mortality table by age and duration as a DataFrame. See basic_term_sample.xlsx included in this library for how the sample mortality rates are created.

>>> Projection.mort_table 0 1 2 3 4 5 Age 18 0.000231 0.000254 0.000280 0.000308 0.000338 0.000372 19 0.000235 0.000259 0.000285 0.000313 0.000345 0.000379 20 0.000240 0.000264 0.000290 0.000319 0.000351 0.000386 21 0.000245 0.000269 0.000296 0.000326 0.000359 0.000394 22 0.000250 0.000275 0.000303 0.000333 0.000367 0.000403 .. ... ... ... ... ... ... 116 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 117 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 118 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 119 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 120 1.000000 1.000000 1.000000 1.000000 1.000000 1.000000 [103 rows x 6 columns]

The DataFrame is saved in the Excel file mort_table.xlsx placed in the model folder.

mort_tableis created by Projection’s new_pandas method, so that the DataFrame is saved in the separate file. The DataFrame has the injected attribute of_mx_dataclident:>>> Projection.mort_table._mx_dataclient <PandasData path='mort_table.xlsx' filetype='excel'>

See also

- std_norm_rand#

Random numbers drawn from the standard normal distribution.

A Series of random numbers drawn from the standard normal distribution indexed with

scen_idandt. Used for generating investment returns. Seeinv_return_table().

- scen_id#

Selected scenario ID

An integer indicating the selected scenario ID.

scen_idis referenced in byinv_return_mth()as one of the keys to select a scenario fromstd_norm_rand.

- surr_charge_table#

Surrender charge rates by duration.

A DataFrame of multiple patterns of surrender charge rates by duration. The column labels indicate

surr_charge_id(). By default,"type_1","type_2"and"type_3"are defined.

- product_spec_table#

Table of product specs.

A DataFrame of product spec parameters by

spec_id.model_point_tableandproduct_spec_tablecolumns are joined inmodel_point_table_ext(), and theproduct_spec_tablecolumns become part of the model point attributes. Theproduct_spec_tablecolumns are read by the Cells with the same names as the columns:>>> Projection.product_spec_table premium_type has_surr_charge surr_charge_id load_prem_rate is_wl spec_id A SINGLE False NaN 0.10 False B SINGLE True type_1 0.00 False C LEVEL False NaN 0.10 True D LEVEL True type_3 0.05 True

Projection parameters#

The time step of the model is monthly. Cashflows and other time-dependent

variables are indexed with t.

Projection is carried out separately for individual model points.

proj_len() calculates the number of months to be

projected for the selected model point.

Cashflows and other flows that accumulate throughout a period

indexed with t denote the sums of the flows from t til t+1.

Balance items indexed with t denote the amount at t.

|

Projection length in months |

Model point data#

The model point data stored in an Excel file named model_point_table.xlsx

under the model folder is read into model_point_table.

Policy attributes that only vary by product spec are

stored separately in another Excel file named product_spec_table.xlsx,

and read into product_spec_table.

The product_spec_table attributes are joined with

model_point_table in model_point_table_ext()

and referenced from model_point().

The selected model point as a Series |

|

Extended model point table |

|

|

The sex of the selected model point |

The sum assured of the selected model point |

|

The policy term of the selected model point. |

|

|

The attained age at time t. |

The age at entry of the selected model point |

|

|

Duration of the selected model point at |

|

Duration of the selected model point at |

Whether surrender charge applies |

|

|

Whether the model point is whole life |

Rate of premium loading |

|

ID of surrender charge pattern |

|

Type of premium payment |

|

Initial account value per policy |

Assumptions#

The mortality table is stored in an Excel file named mort_table.xlsx

under the model folder, and is read into mort_table as a DataFrame.

mort_rate() looks up mort_table and picks up

the annual mortality rate to be applied for the selected

model point at time t.

mort_rate_mth() converts mort_rate() to the monthly mortality

rate to be applied during the month starting at time t.

The discount rate data is stored in an Excel file named disc_rate_ann.xlsx

under the model folder, and is read into disc_rate_ann as a Series.

The lapse by duration is defined by a formula in lapse_rate().

expense_acq() holds the acquisition expense per policy at t=0.

expense_maint() holds the maintenance expense per policy per annum.

The maintenance expense inflates at a constant rate

of inflation given as inflation_rate().

The last age of mortality tables |

|

|

Mortality rate to be applied at time t |

Monthly mortality rate to be applied at time t |

|

Discount factors. |

|

Monthly discount rate |

|

|

Lapse rate |

Acquisition expense per policy |

|

Annual maintenance expense per policy |

|

The inflation factor at time t |

|

Inflation rate |

Policy values#

By default, the amount of death benefit for each policy (claim_pp())

is set equal to sum_assured.

premium_pp() is the single premium amount if the model point

represents single premium policies (i.e. premium_type() is "SINGLE"),

or the monthly premium amount if the model point represents

level premium policies (i.e. premium_type() is "LEVEL").

|

Claim per policy |

|

Premium amount per policy |

Maintenance fee per account value |

|

|

Cost of insurance rate per account value |

Surrender charge rate |

Policy decrement#

At t=0

If the selected model point represents in-force policies, i.e.

the duration_mth of the model point in model_point_table

is positive, pols_if_at(0, "BEF_MAT") is set to

the value through pols_if_init().

At each projection step

pols_if_at(t, timing) represents

the number of policies at t.

The timing parameter can take the following string values.

"BEF_MAT": Before maturity"BEF_NB": Before new business"BEF_DECR": Before lapse and death

Policy flows and in-force at each timing from t-1 to t

are calculated recursively as follows:

pols_if_at(t-1, "BEF_DECR")is calculated by addingpols_new_biz(t-1)topols_if_at(t-1, "BEF_NB").pols_if_at(t, "BEF_MAT")is calculated by deductingpols_lapse(t)andpols_death(t)frompols_if_at(t-1, "BEF_DECR").pols_if_at(t, "BEF_NB")is calculated by deductingpols_maturity(t)frompols_if_at(t, "BEF_MAT").pols_if_at(t, "BEF_DECR")is calculated bypols_new_biz(t)frompols_if_at(t, "BEF_NB").

It is assumed that policies mature at the beginning of each month,

and new business policies enter at the beginning of the month

but after the maturity in that month.

pols_if(t) is an alias

for pols_if_at(t, "BEF_MAT").

The figure below illustrates how various policy inflows and outflows

are modeled in this model for one calculation step

from time t-1 to time t.

|

Number of death |

|

Number of policies in-force |

|

Number of policies in-force |

Initial number of policies in-force |

|

|

Number of lapse |

Number of maturing policies |

|

|

Number of new business policies |

Account Value#

av_pp_at(t, timing) calculates the account value per policy

at t.

Since av_pp_at() can take multiple values for the same t

depending on the timing of various cashflows into and out of the

account value, the second parameter timing is used

to specify the timing of measuring the account value.

av_pp_at(t, 'BEF_PREM') indicates

the account value before premium payment for the month.

At time 0, it is read from av_pp_init(),

otherwise its calculated from the previous period

as av_pp_at(t-1, 'BEF_INV') plus

inv_income_(t-1).

av_pp_at(t, 'BEF_FEE') indicates

the account value after the premium payment before fee deduction, and

is calculated as av_pp_at(t, 'BEF_PREM') plus

prem_to_av_pp().

av_pp_at(t, 'BEF_INV') indicates

the account value after then fee deduction before earning investment yield, and

is calculated as av_pp_at(t, 'BEF_FEE') minus

maint_fee_pp() and coi_pp().

av_pp_at(t, 'MID_MTH') indicates

the account value at t+0.5, and half of inv_income()

is earned. av_pp_at(t, 'MID_MTH') is

for policies exiting by lapse and death during the month.

|

Investment income on account value |

Investment income on account value per policy |

|

Rate of investment return |

|

Table of investment return rates |

|

|

Account value per policy |

Net amount at risk per policy |

|

|

Cost of insurance charges per policy |

Per-policy premium portion put in the account value |

|

|

Maintenance fee per policy |

|

Account value in-force |

|

Premium portion put in account value |

|

Account value taken out to pay claim |

Claim in excess of account value |

|

|

Cost of insurance charges |

|

Maintenance fee deducted from account value |

|

Change in account value |

Check account value roll-forward |

Cashflows#

Cashflows are calculated as its per-policy amount times the number of policies.

The expense cashflow consists of acquisition expenses at issue and monthly maintenance expenses spent each month.

By default, commissions are defined as 5% premiums.

|

Surrender charge |

|

Claims |

|

Commissions |

|

Premium income |

|

Expenses |

|

Net cashflow |

Margin Analysis#

net_cf() can be expressed as the sum of expense and mortality

margins. The expense margin is defined as the sum of

premium loading, surrender charge and maintenance fees

net of commissions and expenses.

The mortality margin is defined coi() net of claims_over_av().

Expense margin |

|

Mortality margin |

|

Check consistency between net cashflow and margins |

Present values#

The Cells whose names start with pv_ are for calculating

the present values of the cashflows indicated by the rest of their names.

pv_pols_if() is not used

in CashValue_SE and BasicTerm_ME.

|

Present value of claims |

Present value of commissions |

|

Present value of expenses |

|

Present value of net cashflows. |

|

Present value of policies in-force |

|

Present value of premiums |

|

Present value of change in account value |

|

Present value of investment income |

|

Check present value summation |

Results#

result_cf() outputs the cashflows of the selected model point

as a DataFrame:

>>> result_cf()

Premiums Death ... Change in AV Net Cashflow

0 50000000.0 999.844857 ... 4.447174e+07 2.033342e+06

1 0.0 991.084783 ... -1.065060e+06 3.292919e+04

2 0.0 982.401460 ... 2.039757e+05 3.208843e+04

3 0.0 973.794216 ... -2.527055e+05 3.228511e+04

4 0.0 965.262383 ... -7.053975e+05 3.210189e+04

.. ... ... ... ... ...

116 0.0 1346.032341 ... 2.851405e+04 2.368209e+04

117 0.0 1343.713636 ... -2.927039e+05 2.370171e+04

118 0.0 1341.398924 ... 4.096877e+05 2.347573e+04

119 0.0 1339.088201 ... 4.207922e+05 2.381819e+04

120 0.0 0.000000 ... -3.263268e+07 0.000000e+00

[121 rows x 9 columns]

result_pv() outputs the present values of the cashflows:

>>> result_pv()

Premiums Death ... Commissions Net Cashflow

PV 50000000.0 135032.740399 ... 2500000.0 4.957050e+06

Result table of cashflows |

|

Result table of present value of cashflows |

|

Result table of policy decrement |