Overview of BasicHullWhite#

The Hull-White model is a short rate model represented by the stochastic differential equiation:

BasicHullWhite in the economic library is a simple implementation of the Hull-White model built using modelx.

BasicHullWhite preforms Monte-Carlo simulations and generates paths of the instantaneous short rate based on the Hull-White model. It also inclues formulas to calculate various properties of the Hull-White model.

Gouthaman Balaraman presents some tests performed on a Hull-White model. He uses QuantLib to build his model, but the BasicHullWhite does not use QuantLib, and its Monte-Carlo simulations are generated from first principles using random numbers following the standard normal distribution. In addition, BasicHullWhite generates values of stochastic variable at each time step at once as a numpy array based on

the vector modeling approach.

This notebook aims to perform analyses similar to Balaraman’s using BasicHullWhite.

References

Overview of the model#

HullWiteModel include only one space, which is named HullWhite, and all the definitions are in that space. The HullWhite space is assined to HW in this notebook.

[1]:

import matplotlib.pyplot as plt

import modelx as mx

model = mx.read_model('BasicHullWhite')

HW = model.HullWhite

All the input parameters except for the initial curve are given as References (names starting with “_” are default names defined by modelx).

[2]:

HW.refs

[2]:

{__builtins__,

_self,

_space,

np,

step_size,

time_len,

a,

sigma,

seed1,

seed2,

scen_size}

The defalut values for the number of scenarios, length of time (\(T\)), number of steps, \(a\), \(\sigma\) are set equal to the Balaraman’s example.

[3]:

print("Number of scenarios:", HW.scen_size)

print("Length of time (in years):", HW.time_len)

print("Number of steps:", HW.step_size)

print("a:", HW.a)

print("sigma:", HW.sigma)

Number of scenarios: 1000

Length of time (in years): 30

Number of steps: 360

a: 0.1

sigma: 0.1

Below is a list of cells defined in HW.

[4]:

HW.cells

[4]:

{A_t_T,

B_t_T,

E_rt,

E_rt_s,

P_t_T,

V_t_T,

Var_rt,

Var_rt_s,

accum_short_rate,

accum_short_rate2,

alpha,

disc_factor,

disc_factor_paths,

mean_disc_factor,

mean_short_rate,

mkt_fwd,

mkt_zcb,

short_rate,

short_rate_paths,

std_norm_rand,

t_,

var_short_rate}

Time-dependent functions are paremeterized with integer indexes instead of times themselves, i.e. \(f(t)\) where \(t=t_i, i=1, 2, 3, \ldots\) in math expression is translated as f(i), i=1, 2, 3... in modelx formula. Mapping \(i\) to \(t_i\) is done by t_(i). By defalut, \(t_i\)s are evenly spaced, but the model should work even if the intervals are set uneven.

[5]:

HW.t_.formula

[5]:

lambda i: i * time_len / step_size

By default, the instanteneous forward rates observed at time 0 (\(f^M(0, t_i)\)) are set to 0.05 in mkt_fwd to be consistent with the Balaraman’s example. \(P^M(0, t_i)\), the market prices of zero-coupon bonds by duration are calculated from \(f^M(0, t_i)\) in mkt_zcb. These may be defined the other way around, i.e. \(f^M(0, t_i)\) may be derived from \(P^M(0, t_i)\) inputs. The forward rates don’t have to be constant.

[6]:

HW.mkt_fwd.formula

[6]:

def mkt_fwd(i):

"""The initial instantaneous forward rate for :attr:`t_(i)<t_>`.

By default, returns 0.05 for all ``i``.

"""

return 0.05

[7]:

HW.mkt_zcb.formula

[7]:

def mkt_zcb(i):

"""The initial price of zero coupon bond

The initial price of the unit zero coupon bond maturing at :attr:`t_(i)<t_>`.

If ``i=0`` returns 1. Otherwise, defined as::

mkt_zcb(i-1) * np.exp(-mkt_fwd(i-1)*dt)

where ``dt = t_(i) - t_(i-1)``.

.. seealso::

* :attr:`t_`

* :attr:`mkt_fwd`

"""

if i == 0:

return 1.0

else:

dt = t_(i) - t_(i-1)

return mkt_zcb(i-1) * np.exp(-mkt_fwd(i-1)*dt)

short_rate corresponds to \(r(t_{i})\), and recursively calculates stochastic paths of the instantaneous short rate at each time step.

[8]:

HW.short_rate.formula

[8]:

def short_rate(i):

r"""Stochastic short rates at :attr:`t_(i)<t_>`

Returns, in a numpy array, simulated stochastic short rates at :attr:`t_(i)<t_>`

for all scenarios.

For ``i=0``, defined as :meth:`mkt_fwd(0)<mkt_fwd>`.

For ``i>0``, defined as

:math:`r(t_i) = E\{r(t_i) | \mathcal{F}_{i-1}\} + \sqrt{Var\{ r(t_i) | \mathcal{F}_{i-1} \}} * Z`,

where :math:`E\{r(t_i) | \mathcal{F}_{i-1}\}`, the expected value of

:math:`r(t_i)` conditional on :math:`\mathcal{F}_{i-1}` is calculated by :meth:`E_rt_s(i-1, i)<E_rt_s>`,

:math:`Var\{ r(t_i) | \mathcal{F}_{i-1} \}` the variance of :math:`r(t_i)` conditional on :math:`\mathcal{F}_{i-1}`

is calculated by :meth:`Var_rt_s(i-1, i)<Var_rt_s>`,

and :math:`Z`, a random number drawn from :math:`\mathcal{N}(0, 1)`

a standard normal distribution calculated by :meth:`std_norm_rand`.

.. seealso::

* :attr:`scen_size`

* :meth:`mkt_fwd`

* :meth:`E_rt_s`

* :meth:`Var_rt_s`

* :meth:`std_norm_rand`

* :attr:`seed1`

"""

if i == 0:

return np.full(scen_size, mkt_fwd(0))

else:

return E_rt_s(i-1, i) + Var_rt_s(i-1, i)**0.5 * std_norm_rand(seed1)[:, i-1]

Note that the initial stochastic differential equation, \(dr(t) = (\theta(t) - a r(t))dt + \sigma dW\) is not used in this model. Rather, the model uses the fact that the Hull-White model is a Gaussian process, and \(r(t^i)\) conditional on $:nbsphinx-math:mathcal{F}{t{i-1}} $ is normally distributed. short_rate(i) corresponds to the following expression

where \(Z\) represents random samples drawn from \(\mathcal{N}(0, 1)\), the strandard normal distribution.

\(E\{r(t_j) | \mathcal{F}_i\}\), the mean of \(r(t_j)\) conditional on $:nbsphinx-math:mathcal{F}_{t_i} $ is modeled as E_rt_s(i, j). By replacing \(t_{i}\) with \(s\) and \(t_{j}\) with \(t\), the mean is expressed as:

where

[9]:

HW.E_rt_s.formula

[9]:

def E_rt_s(i, j):

r"""Conditional expected values of :math:`r(t_j)`

Returns, in a numpy array,

:math:`E\{r(t_j) | \mathcal{F}_{i}\}`,

the expected values of :math:`r(t_j)` conditional on :math:`\mathcal{F}_{i}`

for all scenarios.

:math:`E\{r(t) | \mathcal{F}_{s}\}` is calculated as:

.. math::

r(s)e^{-a(t-s)} + \alpha(t) - \alpha(s)e^{-a(t-s)}

where :math:`\alpha(t)` is calculated by :meth:`alpha`.

.. seealso:

* :meth:`short_rate`

* :meth:`alpha`

"""

s, t = t_(i), t_(j)

r_s = short_rate(i)

return r_s * np.exp(-a * (t-s)) + alpha(j) - alpha(i) * np.exp(-a * (t-s))

[10]:

HW.E_rt.formula

[10]:

def E_rt():

"""The expected values of :math:`r(t_i)` at time 0 for all :math:`t_i`.

Returns, in a numpy array, the expected values of

:math:`r(t_i)` for all :math:`t_i`.

Calculated as :math:`E\{r(t_i) | \mathcal{F}_{0}\}`.

.. seealso::

* :meth:`E_rt_s`

"""

return np.array([E_rt_s(0, i)[0] for i in range(step_size + 1)])

In the same way, \(Var\{r(t_{j}) | \mathcal{F}_{t_i}\}\), the variance of \(r(t_j)\) conditional on \(\mathcal{F}_{t_i}\) is modeled as Var_rt_s(i, j). With the same definitions for \(s\), \(t\), \(\alpha(t)\) as above, the variance is expressed as:

[11]:

HW.Var_rt_s.formula

[11]:

def Var_rt_s(i, j):

r"""The variance of :math:`r(t_j)` conditional on :math:`\mathcal{F}_{t_i}`

:math:`Var\{r(t_{j}) | \mathcal{F}_{t_i}\}`,

the variance of :math:`r(t_j)` conditional on :math:`\mathcal{F}_{t_i}`,

calculated as:

.. math::

Var\{ r(t) | \mathcal{F}_s \} = \frac{\sigma^2}{2a} (1 - e^{-2a(t-s)})

.. seealso::

* :attr:`a`

* :attr:`sigma`

"""

s, t = t_(i), t_(j)

return sigma**2 / (2*a) * (1 - np.exp(-2 * a * (t-s)))

Note that for each i, short_rate(i) returns a 1-dimensional numpy array having scen_size elements, and for each pair of i and j, both E_rt_s(i, j) and Var_rt_s(i, j) also return an array with scen_size elements.

\(\alpha(t_{i})\) is modeled as alpha(i). alpha(i) doesn’t vary by scenario, so it returns a single value for each i.

[12]:

HW.alpha.formula

[12]:

def alpha(i):

r""":math:`\alpha(t_i)`

Returns, in a numpy array, :math:`\alpha(t_i)` for all scenarios.

:math:`\alpha` appears in the expression of

:math:`E\{r(t) | \mathcal{F}_{s}\}` and is defined as:

.. math::

\alpha(t) = f^M(0, t) + \frac{\sigma^2} {2a^2}(1-e^{-at})^2

.. seealso::

* :meth:`E_rt_s`

"""

t = t_(i)

return mkt_fwd(i) + 0.5 * sigma**2 / a**2 * (1 - np.exp(-a*t))**2

Simulating \(r(t_i)\)#

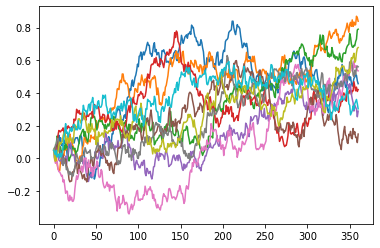

The chart below shows the first 10 paths of \(r(t_i)\). short_rate_paths() is defined to return \(r(t_i)\) for all the scenarios and all the tim steps in a 2-dimensional array.

[13]:

HW.short_rate_paths.formula

[13]:

def short_rate_paths():

"""Short rate paths.

Returns, as a 2D numpy array, the simulated short rate paths

for all scenarios.

.. seealso::

* :meth:`short_rate`

"""

return np.array([short_rate(i) for i in range(step_size + 1)]).transpose()

[14]:

for i in range(10):

plt.plot(range(HW.step_size+1), HW.short_rate_paths()[i])

For each \(t_i\), the mean of \(r(t_i)\) should converge to \(E\{r(t_i) | \mathcal{F}_{0}\}\). For convenience, mean_short_rate and E_rt are defined to represent the mean of \(r(t_i)\) and \(E\{r(t_i) | \mathcal{F}_{0}\}\) respectively.

[15]:

HW.mean_short_rate.formula

[15]:

def mean_short_rate():

"""The means of generated short rates

Returns, as a numpy array, the means of short rates of all scenarios

for all :math:`t_i`.

This should converge to the theoretical variances

calculated by :meth:`E_rt`.

.. seealso::

* :meth:`short_rate`

* :meth:`E_rt`

"""

return np.array([np.mean(short_rate(i)) for i in range(step_size + 1)])

[16]:

HW.E_rt.formula

[16]:

def E_rt():

"""The expected values of :math:`r(t_i)` at time 0 for all :math:`t_i`.

Returns, in a numpy array, the expected values of

:math:`r(t_i)` for all :math:`t_i`.

Calculated as :math:`E\{r(t_i) | \mathcal{F}_{0}\}`.

.. seealso::

* :meth:`E_rt_s`

"""

return np.array([E_rt_s(0, i)[0] for i in range(step_size + 1)])

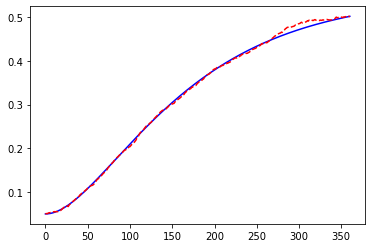

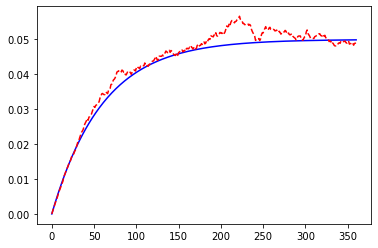

The chart below compares the mean of \(r(t_i)\) against \(E\{r(t_i) | \mathcal{F}_{0}\}\) with 1000 scenarios. The chart looks similar to Balaraman’s analysis. The mean converges pretty well during the first 20 years (240 steps), but diverges from the expectation around the 300th step.

[17]:

HW.scen_size = 1000

plt.plot(range(HW.step_size + 1), HW.E_rt(), "b-")

plt.plot(range(HW.step_size + 1), HW.mean_short_rate(), "r--")

[17]:

[<matplotlib.lines.Line2D at 0x24faa550b20>]

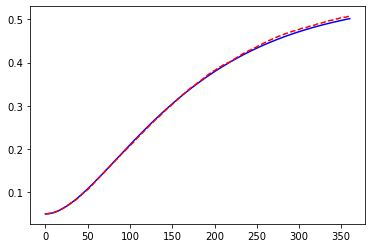

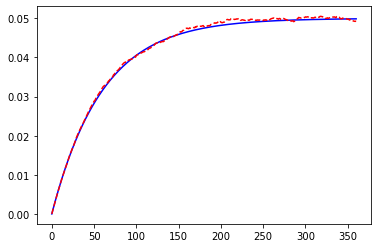

The chart below is with 10,000 scenarios. The divergence dissapears and the mean fits the expectation much better.

[18]:

HW.scen_size = 10000

HW.a = 0.1

HW.sigma = 0.1

plt.plot(range(HW.step_size + 1), HW.E_rt(), "b-")

plt.plot(range(HW.step_size + 1), HW.mean_short_rate(), "r--")

[18]:

[<matplotlib.lines.Line2D at 0x24faa3f3ac0>]

In the same manner as the mean, for each \(t_i\), the variance of \(r(t_i)\) should converge to \(Var\{r(t_i) | \mathcal{F}_{0}\}\). For convenience, var_short_rate and Var_rt are defined to represent the variance of \(r(t_i)\) and \(Var\{r(t_i) | \mathcal{F}_{0}\}\) respectively.

[19]:

HW.var_short_rate.formula

[19]:

def var_short_rate():

"""Variance of generated short rates

Returns, as a vector in a numpy array, the variances of

the generated short rates for all :math:`t_i`.

This should converge to the theoretical variances

calculated by :meth:`Var_rt`.

.. seealso::

* :meth:`short_rate`

* :meth:`Var_rt`

"""

return np.array([np.var(short_rate(i)) for i in range(step_size + 1)])

[20]:

HW.Var_rt.formula

[20]:

def Var_rt():

r"""The variance of :math:`r(t_i)` at time 0 for all :math:`t_i`.

Returns, in a numpy array, the variance of

:math:`r(t_i)` for all :math:`t_i`.

Calculated as :math:`Var\{r(t_i) | \mathcal{F}_{0}\}`.

.. seealso::

* :meth:`Var_rt_s`

"""

return np.array([Var_rt_s(0, i) for i in range(step_size + 1)])

[21]:

HW.scen_size = 1000

plt.plot(range(HW.step_size + 1), HW.Var_rt(), "b-")

plt.plot(range(HW.step_size + 1), HW.var_short_rate(), "r--")

[21]:

[<matplotlib.lines.Line2D at 0x24fa877da30>]

[22]:

HW.scen_size = 10000

plt.plot(range(HW.step_size + 1), HW.Var_rt(), "b-")

plt.plot(range(HW.step_size + 1), HW.var_short_rate(), "r--")

[22]:

[<matplotlib.lines.Line2D at 0x24fa8416910>]

Simulating the discount factor#

Along with \(r(t_{i})\), the discount factor needs to be simulated. The discount factor is defined as \(e^{-Y(t_i)}\) where

For simplicity, we model \(Y(t_i)\) as a descrete approximation to the integral:

[23]:

HW.accum_short_rate.formula

[23]:

def accum_short_rate(i):

r"""Accumulated short rates.

a descrete approximation to the integral :math:`\int_0^{t_i}r(t)dt`,

calculated as :math:`\sum_{j=1}^{i}r(t_{j-1})(t_j-t_{j-1})`

.. seealso::

* :meth:`disc_factor`

"""

if i == 0:

return np.full(scen_size, 0.0)

else:

dt = t_(i) - t_(i-1)

return accum_short_rate(i-1) + short_rate(i-1) * dt

There is an alternative approach to simulate \(Y(t_i)\) by using the fact that \(Y(t_i)\) follows a normal distribution, and by simulating the joint distribution of \((r(t_i), Y(t_i))\) as suggested in Monte Carlo Methods in Financial Engineering. accum_short_rate2 implements this alternative approach, althogh it does not have material impact on the discussion below.

[24]:

HW.accum_short_rate2.formula

[24]:

def accum_short_rate2(i):

r"""Alternative implementation of accumulated short rates.

An alternative approach to simulate :math:`Y(t_i)=\int_0^{t_i}r(t)dt`

by using the fact that :math:`Y(t_i)` follows a normal distribution,

and by simulating the joint distribution of :math:`(r(t_i), Y(t_i))`,

as suggested in Glasserman (2003).

.. seealso::

* :meth:`accum_short_rate`

* :attr:`seed2`

* Paul Glasserman (2003). Monte Carlo Methods in Financial Engineering

"""

if i == 0:

return np.full(scen_size, 0.0)

else:

t, T = t_(i-1), t_(i)

dt = T - t

cov = sigma**2/(2*a**2)*(1 + np.exp(-2*a*dt) -2 * np.exp(-a*dt))

z1 = std_norm_rand(seed1)[:, i-1]

z2 = std_norm_rand(seed2)[:, i-1]

rho = cov / (Var_rt_s(i-1, i)**0.5 * V_t_T(i-1, i)**0.5)

mean = B_t_T(i-1, i) * (short_rate(i-1) - alpha(i-1)) + np.log(mkt_zcb(i-1)/mkt_zcb(i)) + 0.5*(V_t_T(0, i)-V_t_T(0, i-1))

return accum_short_rate2(i-1) + mean + V_t_T(i-1, i)**0.5 * (rho*z1 + (1-rho**2)**0.5*z2)

discount_factor and mean_disc_factor are defined as follows.

[25]:

HW.disc_factor.formula

[25]:

def disc_factor(i):

"""Discount factors

Returns, in a numpy array, the discount factors for

cashflows at :math:`t_i` for all scenarios.

Defined as::

np.exp(-accum_short_rate(i))

.. seealso::

* accum_short_rate

"""

return np.exp(-accum_short_rate(i))

[26]:

HW.mean_disc_factor.formula

[26]:

def mean_disc_factor():

"""Discount factor means

Returns, as a numpy array, the mean of discount factors of all scenarios

for each :math:`t_i`.

.. seealso::

* :meth:`disc_factor`

"""

return np.array([np.mean(disc_factor(i)) for i in range(step_size + 1)])

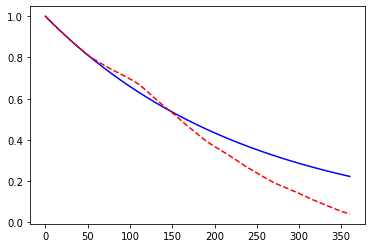

The chart below compares the mean of the simulated discount factors against \(P^M(0, t_i)\) with 1000 scenarios. The mean diverges from the expectation significantly after the 150th step.

[27]:

HW.scen_size = 1000

plt.plot(range(HW.step_size+1), [HW.mkt_zcb(i) for i in range(HW.step_size+1)], "b-")

plt.plot(range(HW.step_size+1), HW.mean_disc_factor(), "r--")

[27]:

[<matplotlib.lines.Line2D at 0x24fa85de9d0>]

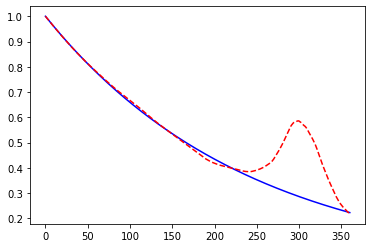

The chart shows the case of 10,000 scenarios. The stochastic mean does not converge well. Even with 100,000 scenarios, the convergence is still poor.

[28]:

HW.scen_size = 10000

plt.plot(range(HW.step_size+1), [HW.mkt_zcb(i) for i in range(HW.step_size+1)], "b-")

plt.plot(range(HW.step_size+1), HW.mean_disc_factor(), "r--")

[28]:

[<matplotlib.lines.Line2D at 0x24fa8643460>]

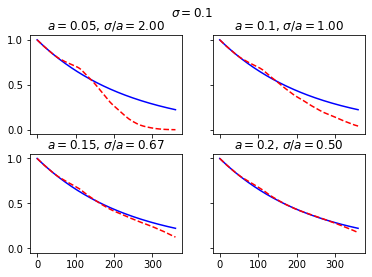

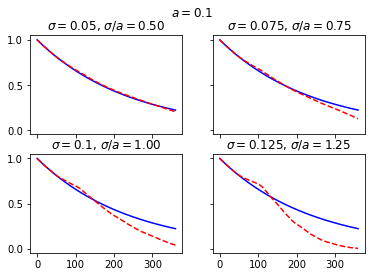

The charts below examine the convergence of the discount factor for various combinations of \(\sigma\) and \(a\), first by changing \(\sigma\) and secondly by changing \(a\). As Balaraman’s study shows, the convergence gets worse as \(\sigma/a\) gets larger than 1, and gets better as \(\sigma/a\) gets smaller than 1.

[29]:

HW.scen_size = 1000

fig, axs = plt.subplots(2, 2, sharex=True, sharey=True)

fig.suptitle(r"$a=$" + str(HW.a))

for sigma, (h, v) in zip([0.05, 0.075, 0.1, 0.125], [(0, 0), (0, 1), (1, 0), (1, 1)]):

HW.sigma = sigma

axs[h, v].set_title(r"$\sigma=$" + str(sigma) + r", $\sigma/a=$" + "%.2f" % (sigma/HW.a))

axs[h, v].plot(range(HW.step_size+1), [HW.mkt_zcb(i) for i in range(HW.step_size+1)], "b-")

axs[h, v].plot(range(HW.step_size+1), HW.mean_disc_factor(), "r--")

[30]:

HW.scen_size = 1000

HW.sigma = 0.1

fig, axs = plt.subplots(2, 2, sharex=True, sharey=True)

fig.suptitle(r"$\sigma=$" + str(HW.sigma))

for a, (h, v) in zip([0.05, 0.1, 0.15, 0.2], [(0, 0), (0, 1), (1, 0), (1, 1)]):

HW.a = a

axs[h, v].set_title(r"$a=$" + str(a) + r", $\sigma/a=$" + "%.2f" % (HW.sigma/HW.a))

axs[h, v].plot(range(HW.step_size+1), [HW.mkt_zcb(i) for i in range(HW.step_size+1)], "b-")

axs[h, v].plot(range(HW.step_size+1), HW.mean_disc_factor(), "r--")