1. Simple Stochastic Example¶

This example shows how to calculate TVOG (Time Value of Options and Guarantees) on a plain variable annuity product with GMAB by two methods, Monte Carlo simulation with 10,000 risk-neutral scenaios and the Black-Scholes-Merton option pricing formula for European put options.

For this example, the CashValue_ME_EX1 model is developed from CashValue_ME and included in the savings library. This Jupyter notebook describes CashValue_ME_EX1, and explains the changes made to devolop CashValue_ME_EX1 from CashValue_ME.

To make the results easily comparable, the CashValue_ME_EX1 model assumes no policy decrement and no fees(i.e. mortality and lapse assumptions, M&E fees and COI chages are set to 0 in the model).

Change summary¶

The following page shows a complete comparison of formulas between CashValue_ME_EX1 and CashValue_ME with highlights on updated parts.

https://www.diffchecker.com/rKGSoxPL

The following cells are newly added in CashValue_ME_EX1. std_norm_rand is changed from a Reference to a Cells.

claim_net_ppformula_option_putpv_claims_from_avscen_indexstd_norm_rand

The formulas of the following cells are updated.

claim_ppcoi_rateinv_return_mthinv_return_tablelapase_ratemaint_fee_ratemodel_pointmort_rate

Warning:

CashValue_ME_EX1 is based on CashValue_ME in lifelib v0.13.1. Changes made on CashValue_ME newer than v0.13.1 may not be reflacted in CashValue_ME_EX1.

The code below imports essential modules, reads the CashValue_ME_EX1 model into Python, and defines proj as an alias for the Projection in the model for convenience.

[28]:

import numpy as np

import pandas as pd

import modelx as mx

model = mx.read_model('CashValue_ME_EX1')

proj = model.Projection

UserWarning: Existing model 'CashValue_ME_EX1' renamed to 'CashValue_ME_EX1_BAK1'

Input data¶

By defalut, a model point table with a single model piont is assigned to model_point_table (and also to model_point_1). The model point is 100 of 10-year new business policies whose initial premiums are all 450,000 and sum assureds are all 500,000. There is another table, model_point_moneyness, defined in the model, which is used later for calculating TVOG for varying levels of initial account value.

[29]:

proj.model_point_table

[29]:

| spec_id | age_at_entry | sex | policy_term | policy_count | sum_assured | duration_mth | premium_pp | av_pp_init | accum_prem_init_pp | |

|---|---|---|---|---|---|---|---|---|---|---|

| poind_id | ||||||||||

| 1 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 |

The product spec table is slightly modified from the one in CashValue_ME. load_prem_rate is changed to 0 for the product A. In this example, the level of account value against sum assured at issue is controled by premium_pp in model_point_table, not by load_prem_rate in product_spec_table.

[30]:

proj.product_spec_table

[30]:

| premium_type | has_surr_charge | surr_charge_id | load_prem_rate | is_wl | |

|---|---|---|---|---|---|

| spec_id | |||||

| A | SINGLE | False | NaN | 0.00 | False |

| B | SINGLE | True | type_1 | 0.00 | False |

| C | LEVEL | False | NaN | 0.10 | True |

| D | LEVEL | True | type_3 | 0.05 | True |

Discount rates are read from disc_rate_ann.xlsx into disc_rate_ann. To make Monte Calo and Black-Scholes-Merton comparable, a constant continuous compound rate of 2% is assumed for discounting. disc_rate_ann holds the annual compound rate converted from the continuous compound rate of 2%.

[31]:

proj.disc_rate_ann

[31]:

year

0 0.020201

1 0.020201

2 0.020201

3 0.020201

4 0.020201

...

146 0.020201

147 0.020201

148 0.020201

149 0.020201

150 0.020201

Name: zero_spot, Length: 151, dtype: float64

Turing off policy decrement and fees¶

To make this example simple, policy decrement and fees are all set to 0 in CashValue_ME_EX1. Changes are made to relevant formulas. For example, the formula of lapse_rate now returns a Series of 0 as shown below. The docstring is not udated from the original formula.

[32]:

proj.lapse_rate.formula

[32]:

def lapse_rate(t):

"""Lapse rate

By default, the lapse rate assumption is defined by duration as::

max(0.1 - 0.02 * duration(t), 0.02)

.. seealso::

:func:`duration`

"""

# return np.maximum(0.1 - 0.02 * duration(t), 0.02)

return pd.Series(0, index=model_point().index)

Adding GMAB¶

By default, the products in CashValue_ME have no minimum guarantee on maturity benefits. To add GMAB, some formulas are added or updated in CashValue_ME_EX1 as shown below. Docstrings are not updated.

[33]:

proj.claim_net_pp.formula

[33]:

def claim_net_pp(t, kind):

if kind == "DEATH":

return claim_pp(t, "DEATH") - av_pp_at(t, "MID_MTH")

elif kind == "LAPSE":

return 0

elif kind == "MATURITY":

return claim_pp(t, "MATURITY") - av_pp_at(t, "BEF_PREM")

else:

raise ValueError("invalid kind")

[34]:

proj.claim_pp.formula

[34]:

def claim_pp(t, kind):

"""Claim per policy

The claim amount per policy. The second parameter

is to indicate the type of the claim, and

it takes a string, which is either ``"DEATH"``, ``"LAPSE"`` or ``"MATURITY"``.

The death benefit as denoted by ``"DEATH"``, is

the greater of :func:`sum_assured` and

mid-month account value (:func:`av_pp_at(t, "MID_MTH")<av_pp_at>`).

The surrender benefit as denoted by ``"LAPSE"`` and

the maturity benefit as denoted by ``"MATURITY"`` are

equal to the mid-month account value.

.. seealso::

* :func:`sum_assured`

* :func:`av_pp_at`

"""

if kind == "DEATH":

return np.maximum(sum_assured(), av_pp_at(t, "MID_MTH"))

elif kind == "LAPSE":

return av_pp_at(t, "MID_MTH")

elif kind == "MATURITY":

return np.maximum(sum_assured(), av_pp_at(t, "BEF_PREM"))

else:

raise ValueError("invalid kind")

Making the model stochastic¶

The approach taken for this example to make CashValue_ME stochastic is to index model_point not by model point ID, but by the combination of scenaio ID and model point ID. Based on this approach, the model_point DataFrame has a MultiIndex, which has two levels, scenario ID denoted by scen_id and model point ID denoted by scen_id, and now the number of rows in model_point is the number of scenaios times the number of model points. For each model point ID, there are

identical model points as many as the number of scnarios.

This approach consumes more memory, but the changes to be made in the model are minimal, and the model runs fast because an identical operation on all the model points across all the scenarios can be performed at the same time as a vector operation along the MultiIndex of model_point.

To make model_point indexed with scen_id and point_id, its formula is changed as follows. The docstring is not updated.

[35]:

proj.model_point.formula

[35]:

def model_point():

"""Target model points

Returns as a DataFrame the model points to be in the scope of calculation.

By default, this Cells returns the entire :func:`model_point_table_ext`

without change.

:func:`model_point_table_ext` is the extended model point table,

which extends :attr:`model_point_table` by joining the columns

in :attr:`product_spec_table`. Do not directly refer to

:attr:`model_point_table` in this formula.

To select model points, change this formula so that this

Cells returns a DataFrame that contains only the selected model points.

Examples:

To select only the model point 1::

def model_point():

return model_point_table_ext().loc[1:1]

To select model points whose ages at entry are 40 or greater::

def model_point():

return model_point_table[model_point_table_ext()["age_at_entry"] >= 40]

Note that the shape of the returned DataFrame must be the

same as the original DataFrame, i.e. :func:`model_point_table_ext`.

When selecting only one model point, make sure the

returned object is a DataFrame, not a Series, as seen in the example

above where ``model_point_table_ext().loc[1:1]`` is specified

instead of ``model_point_table_ext().loc[1]``.

Be careful not to accidentally change the original table

held in :func:`model_point_table_ext`.

.. seealso::

* :func:`model_point_table_ext`

"""

mps = model_point_table_ext()

idx = pd.MultiIndex.from_product(

[mps.index, scen_index()],

names = mps.index.names + scen_index().names

)

res = pd.DataFrame(

np.repeat(mps.values, len(scen_index()), axis=0),

index=idx,

columns=mps.columns

)

return res.astype(mps.dtypes)

Now model_point looks like below. Since model_point_table has only one model point, model_point has 10,000 rows. When the current table is replaced with the other one with 9 model points later in this example, model_point will have 90,000 rows.

[36]:

proj.model_point()

[36]:

| spec_id | age_at_entry | sex | policy_term | policy_count | sum_assured | duration_mth | premium_pp | av_pp_init | accum_prem_init_pp | premium_type | has_surr_charge | surr_charge_id | load_prem_rate | is_wl | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| poind_id | scen_id | |||||||||||||||

| 1 | 1 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False |

| 2 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| 3 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| 4 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| 5 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | |

| 9996 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| 9997 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| 9998 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| 9999 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False | |

| 10000 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 | SINGLE | False | NaN | 0.0 | False |

10000 rows × 15 columns

In CashValue_ME, std_norm_rand is a Series of random numbers read from an input file. In CashValue_ME_EX1, std_norm_rand generates random numbers that follow the standard normal distribution. Depending the version of NumPy, a different random number generator is used. std_norm_rand generates random numbers for t=0 through t=241, although scenarios only up to t=120 are used in this example. For each t, 10,000 random numbers are generated.

[37]:

proj.std_norm_rand.formula

[37]:

def std_norm_rand():

if hasattr(np.random, 'default_rng'):

gen = np.random.default_rng(1234)

rnd = gen.standard_normal(scen_size * 242)

else:

np.random.seed(1234)

rnd = np.random.standard_normal(size=scen_size * 242)

idx = pd.MultiIndex.from_product(

[range(1, scen_size + 1), range(242)],

names = ['scen_id', 't']

)

return pd.Series(rnd, index=idx)

[38]:

proj.std_norm_rand()

[38]:

scen_id t

1 0 0.471435

1 -1.190976

2 1.432707

3 -0.312652

4 -0.720589

...

10000 237 0.437618

238 0.342740

239 1.041453

240 -1.627517

241 0.054268

Length: 2420000, dtype: float64

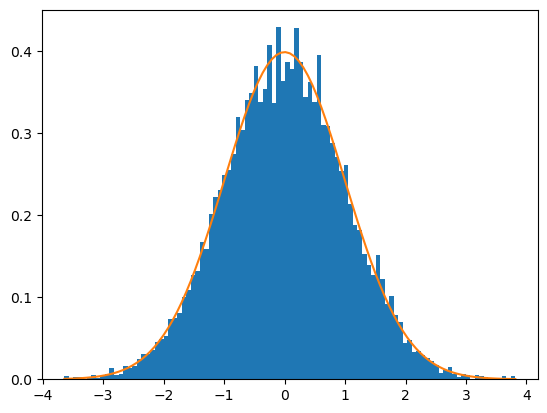

The graph show how well the 10,000 random numbers generated for t=0 fit the PDF of the standard normal distribution.

[39]:

import matplotlib.pyplot as plt

from scipy.stats import norm

t = 0

num_bins = 100

fig, ax = plt.subplots()

n, bins, patches = ax.hist(proj.std_norm_rand()[:,t], bins=num_bins, density=True)

ax.plot(bins, norm.pdf(bins), '-')

plt.show()

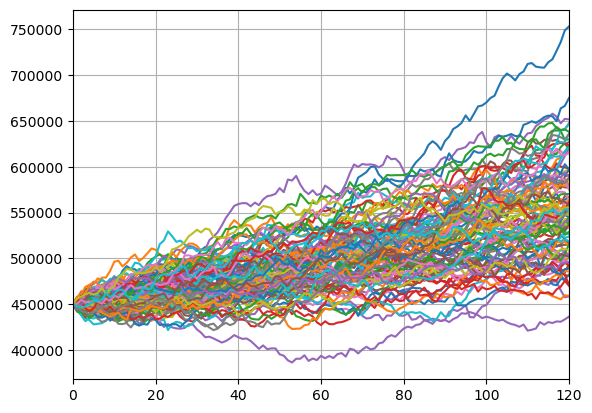

Stochastic account value projection¶

Using on the generated random numbers, the account value is projected stochastically. 10,000 paths are generated. The graph below shows the first 100 paths.

[40]:

avs = list(proj.av_pp_at(t, 'BEF_FEE') for t in range(proj.max_proj_len()))

df = pd.DataFrame(avs)[1]

scen_size = 100

df[range(1, scen_size + 1)].plot.line(legend=False, grid=True)

plt.show()

The investment return on the account value is modeled to follow the geometric Brownian motion:

where \(\Delta{S}\) is the change in the account value \(S\) in a small interval of time, \(\Delta{t}\). \(r\) is the constant risk free rate, \(\sigma\) is the volatility of the account value and \(\epsilon\) is a random number drawn from the standard normal distribution.

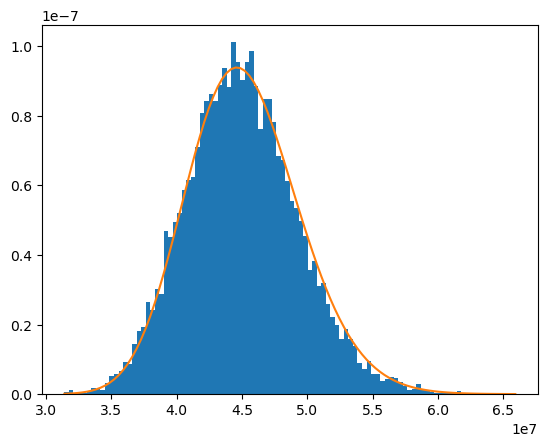

The distibution of the account value at t=120 follows a log normal distribution. In the expression below, \(S_{T}\) and \(S_{0}\) denote account value at \(t=T\) and \(t=0\) respectively.

The graph shows how well the distribution of \(e^{-rT}S_{T}\), the present values of the account value at t=0, fits the PDF of a log normal ditribution.

Reference: Options, Futures, and Other Derivatives by John C.Hull

[41]:

from scipy.stats import lognorm

S0 = 45000000

sigma = 0.03

T = 10

ST = model.Projection.pv_claims_from_av('MATURITY')

fig, ax = plt.subplots()

n, bins, patches = ax.hist(ST, bins=num_bins, density=True)

ax.plot(bins, lognorm.pdf(bins, sigma * T**0.5, scale=S0), '-')

plt.show()

Since the scenarios are risk neutral, the following equation should hold.

[42]:

np.average(ST)

[42]:

44999508.49017615

[43]:

np.average(ST) / S0

[43]:

0.99998907755947

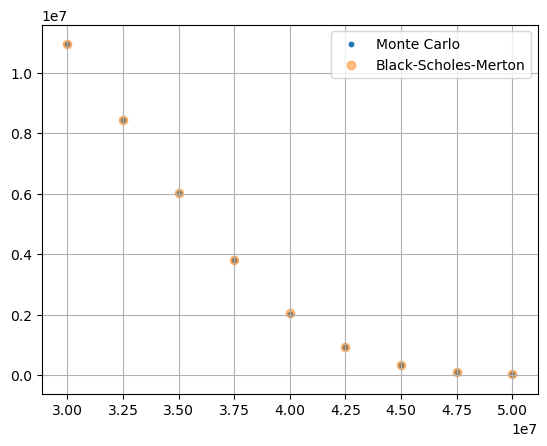

Comparing Monte Calo with Black-Scholes-Merton formula¶

To check the Monte Carlo result, the Black-Scholes-Merton formula for pricing European put options is added to the model.\(X\) corresponds to the sum assured in this example.

Reference: Options, Futures, and Other Derivatives by John C.Hull

[44]:

proj.formula_option_put.formula

[44]:

def formula_option_put(t):

"""

S: prem_to_av

X: claims

sigma: 0.03

r: 0.02

"""

mps = model_point_table_ext()

cond = mps['policy_term'] * 12 == t

mps = mps.loc[cond]

T = t / 12

S = av_at(0, 'BEF_FEE')[:, 1][cond]

X = (sum_assured() * pols_maturity(t))[:, 1][cond]

sigma = 0.03

r = 0.02

N = stats.norm.cdf

e = np.exp

d1 = (np.log(S/X) + (r + 0.5 * sigma**2) * T) / (sigma * np.sqrt(T))

d2 = d1 - sigma * np.sqrt(T)

return X * e(-r*T) * N(-d2) - S * N(-d1)

To get results for various in-the-moneyness, model_point_table is replaced with the other table, model_point_moneyness. model_point_moneyness has 9 model points whose initial account values range from 300,000 to 500,000 by the 25,000 interval

[45]:

proj.model_point_table = proj.model_point_moneyness

proj.model_point_table

[45]:

| spec_id | age_at_entry | sex | policy_term | policy_count | sum_assured | duration_mth | premium_pp | av_pp_init | accum_prem_init_pp | |

|---|---|---|---|---|---|---|---|---|---|---|

| point_id | ||||||||||

| 1 | A | 20 | M | 10 | 100 | 500000 | 0 | 500000 | 0 | 0 |

| 2 | A | 20 | M | 10 | 100 | 500000 | 0 | 475000 | 0 | 0 |

| 3 | A | 20 | M | 10 | 100 | 500000 | 0 | 450000 | 0 | 0 |

| 4 | A | 20 | M | 10 | 100 | 500000 | 0 | 425000 | 0 | 0 |

| 5 | A | 20 | M | 10 | 100 | 500000 | 0 | 400000 | 0 | 0 |

| 6 | A | 20 | M | 10 | 100 | 500000 | 0 | 375000 | 0 | 0 |

| 7 | A | 20 | M | 10 | 100 | 500000 | 0 | 350000 | 0 | 0 |

| 8 | A | 20 | M | 10 | 100 | 500000 | 0 | 325000 | 0 | 0 |

| 9 | A | 20 | M | 10 | 100 | 500000 | 0 | 300000 | 0 | 0 |

pv_claims_over_av('MATURITY') returns the present value of GMAB payouts in Numpy array. The code below converts the array into Series by adding the MultiIndex of model_point.

[46]:

result = pd.Series(proj.pv_claims_over_av('MATURITY'), index=proj.model_point().index)

result

[46]:

point_id scen_id

1 1 0.000000e+00

2 0.000000e+00

3 0.000000e+00

4 0.000000e+00

5 0.000000e+00

...

9 9996 9.240022e+06

9997 1.021809e+07

9998 1.052248e+07

9999 7.923604e+06

10000 8.762142e+06

Length: 90000, dtype: float64

By taking the mean of all the scenarios for each point_id, TVOGs by Monte Carlo are obtained.

[47]:

monte_carlo = result.groupby(level='point_id').mean()

monte_carlo

[47]:

point_id

1 2.803152e+04

2 1.088818e+05

3 3.474952e+05

4 9.191133e+05

5 2.037781e+06

6 3.790617e+06

7 6.013280e+06

8 8.447048e+06

9 1.093782e+07

dtype: float64

The code below shows the same results obtained from the Black-Scholes-Merton formula, and the both results are compared and plotted in the graph below.

[48]:

black_scholes = proj.formula_option_put(120)

black_scholes

[49]:

monte_carlo / black_scholes

[49]:

point_id

1 1.033744

2 1.038543

3 1.020366

4 1.001122

5 0.996667

6 0.999295

7 1.000493

8 1.000236

9 1.000075

dtype: float64

[50]:

S0 = proj.model_point_table['premium_pp'] * proj.model_point_table['policy_count']

fig, ax = plt.subplots()

ax.scatter(S0, monte_carlo, s= 10, alpha=1, label='Monte Carlo')

ax.scatter(S0, black_scholes, alpha=0.5, label='Black-Scholes-Merton')

ax.legend()

ax.grid(True)

plt.show()