Note

Click here to download the full example code

Account value distribution#

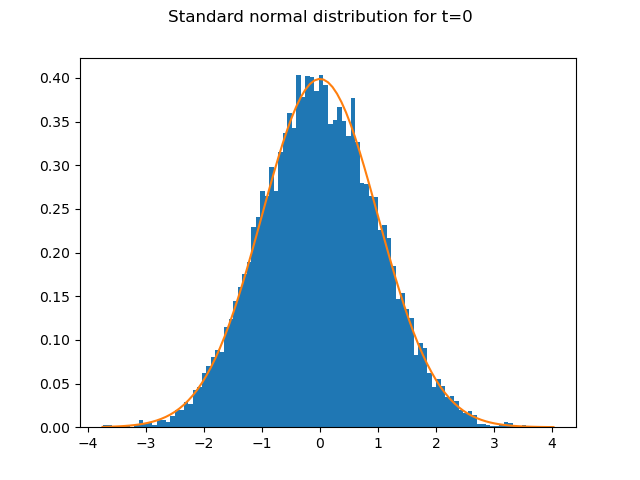

10,000 random numbers drawn from the standard normal distribution

are generated for each time step.

The graph shows how well the 10,000 random numbers for t=0

fit the PDF of the standard normal distribution.

import modelx as mx

import pandas as pd

import matplotlib.pyplot as plt

from scipy.stats import norm, lognorm

import numpy as np

model = mx.read_model("CashValue_ME_EX1")

rand_nums = model.Projection.std_norm_rand()

pv_avs = model.Projection.pv_claims_from_av('MATURITY')

num_bins = 100

S0 = 45000000

sigma = 0.03

T = 10

fig, ax = plt.subplots()

n, bins, patches = ax.hist(rand_nums[:, 0], bins=num_bins, density=True)

ax.plot(bins, norm.pdf(bins), '-')

fig.suptitle('Standard normal distribution for t=0')

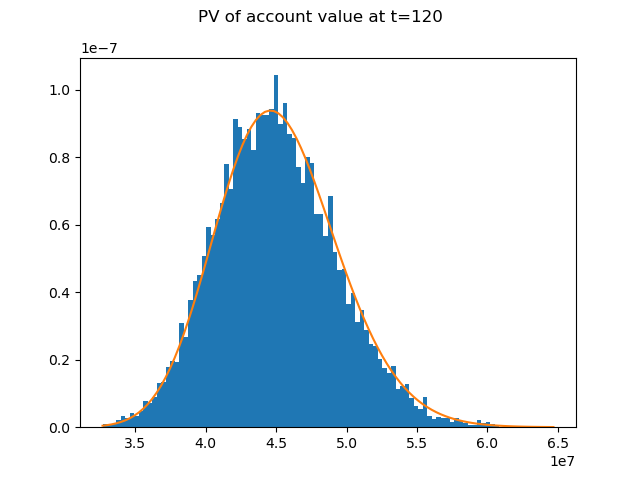

The distibution of the account value at t=120 follows a log normal distribution.

In the expression below, \(S_{T}\) and \(S_{0}\) denote the account value

at t=T=120 and t=0 respectively.

The graph shows how well the distribution of \(e^{-rT}S_{T}\), the present values of the account value at t=0, fits the PDF of a log normal ditribution.

Reference: Options, Futures, and Other Derivatives by John C.Hull

See also

1. Simple Stochastic Example notebook in the

savingslibrary

fig, ax = plt.subplots()

n, bins, patches = ax.hist(pv_avs, bins=num_bins, density=True)

ax.plot(bins, lognorm.pdf(bins, sigma * T**0.5, scale=S0), '-')

fig.suptitle('PV of account value at t=120')

Total running time of the script: ( 0 minutes 1.304 seconds)