Note

Click here to download the full example code

Monte Carlo vs Black-Scholes-Merton¶

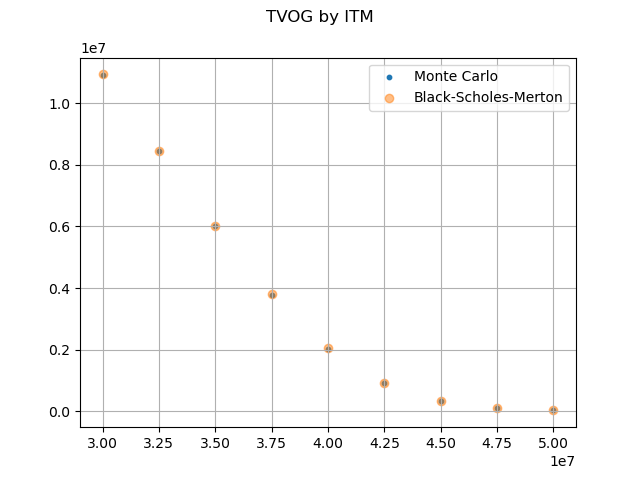

Time values of options and guarantees for various in-the-moneyness are calculated using Monte Carlo simulations and the Black-Scholes-Merton pricing formula for European put options.

The Black-Scholes-Merton pricing formula for European put options can be expressed as below, where \(X\) and \(S_{0}\) correspond to the sum assured and the initial account value in this example.

The graph below shows the results obtained from the Monte Carlo simulations with 10,000 risk neutral scenarios, and from the Black-Scholes-Merton formula.

Reference: Options, Futures, and Other Derivatives by John C.Hull

See also

1. Simple Stochastic Example notebook in the

savingslibrary

import modelx as mx

import pandas as pd

import matplotlib.pyplot as plt

from scipy.stats import norm, lognorm

import numpy as np

model = mx.read_model("CashValue_ME_EX1")

proj = model.Projection

proj.model_point_table = proj.model_point_moneyness

monte_carlo = pd.Series(proj.pv_claims_over_av('MATURITY'), index=proj.model_point().index)

monte_carlo = list(np.average(monte_carlo[i]) for i in range(1, 10))

S0 = proj.model_point_table['premium_pp'] * proj.model_point_table['policy_count']

fig, ax = plt.subplots()

ax.scatter(S0, monte_carlo, s= 10, alpha=1, label='Monte Carlo')

ax.scatter(S0, proj.formula_option_put(120), alpha=0.5, label='Black-Scholes-Merton')

ax.legend()

ax.grid(True)

fig.suptitle('TVOG by ITM')

Total running time of the script: ( 0 minutes 2.524 seconds)