Note

Click here to download the full example code

Account value distribution¶

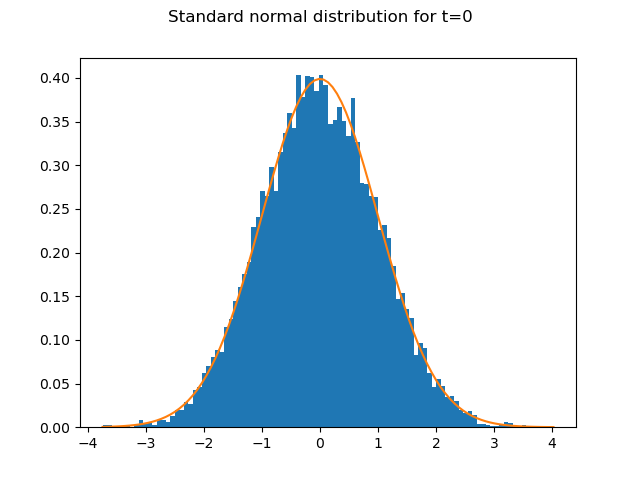

10,000 random numbers drawn from the standard normal distribution

are generated for each time step.

The graph shows how well the 10,000 random numbers for t=0

fit the PDF of the standard normal distribution.

import modelx as mx

import pandas as pd

import matplotlib.pyplot as plt

from scipy.stats import norm, lognorm

import numpy as np

model = mx.read_model("CashValue_ME_EX1")

rand_nums = model.Projection.std_norm_rand()

pv_avs = model.Projection.pv_claims_from_av('MATURITY')

num_bins = 100

S0 = 45000000

sigma = 0.03

T = 10

fig, ax = plt.subplots()

n, bins, patches = ax.hist(rand_nums[:, 0], bins=num_bins, density=True)

ax.plot(bins, norm.pdf(bins), '-')

fig.suptitle('Standard normal distribution for t=0')

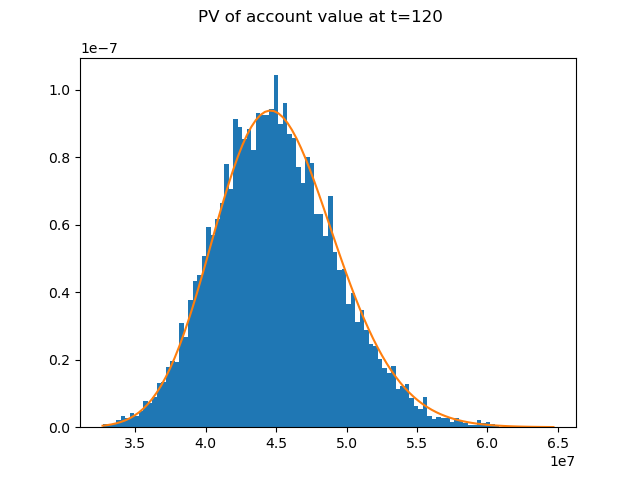

The distibution of the account value at t=120 follows a log normal distribution.

In the expression below, \(S_{T}\) and \(S_{0}\) denote the account value

at t=T=120 and t=0 respectively.

The graph shows how well the distribution of \(e^{-rT}S_{T}\), the present values of the account value at t=0, fits the PDF of a log normal ditribution.

Reference: Options, Futures, and Other Derivatives by John C.Hull

See also

1. Simple Stochastic Example notebook in the

savingslibrary

fig, ax = plt.subplots()

n, bins, patches = ax.hist(pv_avs, bins=num_bins, density=True)

ax.plot(bins, lognorm.pdf(bins, sigma * T**0.5, scale=S0), '-')

fig.suptitle('PV of account value at t=120')

Total running time of the script: ( 0 minutes 1.380 seconds)