Note

Click here to download the full example code

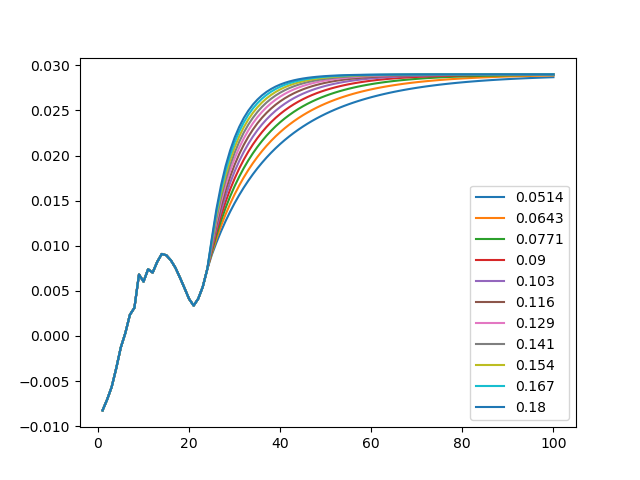

Smith-Wilson extrapolation with various alphas¶

This notebook reads in the smithwilson model, and extrapolates forward rates using the Smith-Wilson method with various alphas, and draws the forward rates. See Project smithwilson for the details of the smithwilson model.

The source of the input data is Switzerland EIOPA spot rates with LLP 25 years available from the following source.

Source: RFR_spot_no_VA tab in EIOPA_RFR_20190531_Term_Structures.xlsx, archived in EIOPA_RFR_20190531.zip, avaialble on EIOPA’s Risk-Free Interest Rate Term Structures web site.

import modelx as mx

import pandas as pd

The code below reads the smithwilson model from “model” folder,

and assign SmithWilson space in the model to

a global variable named space.

space = mx.read_model("model").SmithWilson

The code below is for parametrizing the SmithWilson space by x.

The parameter x takes integer values, and they can be positive and negative.

the alpha in the SmithWilson[x] space is adjusted from the original alpha

by x times 10%.

def parametrize(x):

return {"refs": {"alpha": alpha * (1 + 0.1*x)}}

space.formula = parametrize

The code below creates the ForwardRates cells,

which calculates extrapolated forward rates from

the present values of bond prices.

@mx.defcells

def ForwardRates(t):

return P(t) / P(t+1) - 1

The code below plots the extrapolated forward rates with various alphas.

d = {"{0:.3}".format(space.alpha * (1 + 0.1*x)):

[space[x].ForwardRates[t] for t in range(1, 101)]

for x in range(-6, 5)}

df = pd.DataFrame(d, index=range(1, 101))

df.plot.line()

Total running time of the script: ( 0 minutes 0.693 seconds)