Note

Click here to download the full example code

Black-Scholes-Merton on dividend paying stock¶

As the 2. Extended Stochastic Example shows, time values of options and guarantees on a GMAB policy can be calculated using the Black-Scholes-Merton formula on a dividend paying stock, when maintenance fees are deducted from account value at a constant rate, by regarding the fees as dividends.

The Black-Scholes-Merton pricing formula for European put options on a dividend paying stock can be expressed as below, where \(X\), \(S_{0}\), \(q\) correspond to the sum assured, the initial account value and the maintenence fee rate(1%) in this example.

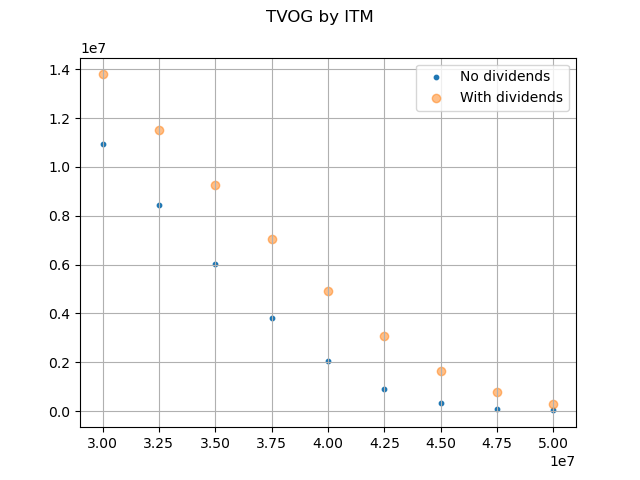

The graph below compares the option values with the maintenance fee deduction against the corresponding values without fee deduction for various in-the-moneyness.

Reference: Options, Futures, and Other Derivatives by John C.Hull

See also

1. Simple Stochastic Example notebook in the

savingslibrary2. Extended Stochastic Example notebook in the

savingslibrary

import modelx as mx

import pandas as pd

import matplotlib.pyplot as plt

from scipy.stats import norm, lognorm

import numpy as np

ex1 = mx.read_model("CashValue_ME_EX1").Projection

ex2 = mx.read_model("CashValue_ME_EX2").Projection

ex1.model_point_table = ex1.model_point_moneyness

ex2.model_point_table = ex2.model_point_moneyness

S0 = ex1.model_point_table['premium_pp'] * ex1.model_point_table['policy_count']

fig, ax = plt.subplots()

ax.scatter(S0, ex1.formula_option_put(120), s= 10, alpha=1, label='No dividends')

ax.scatter(S0, ex2.formula_option_put(120), alpha=0.5, label='With dividends')

ax.legend()

ax.grid(True)

fig.suptitle('TVOG by ITM')

ex1.model.close()

ex2.model.close()

Total running time of the script: ( 0 minutes 1.831 seconds)